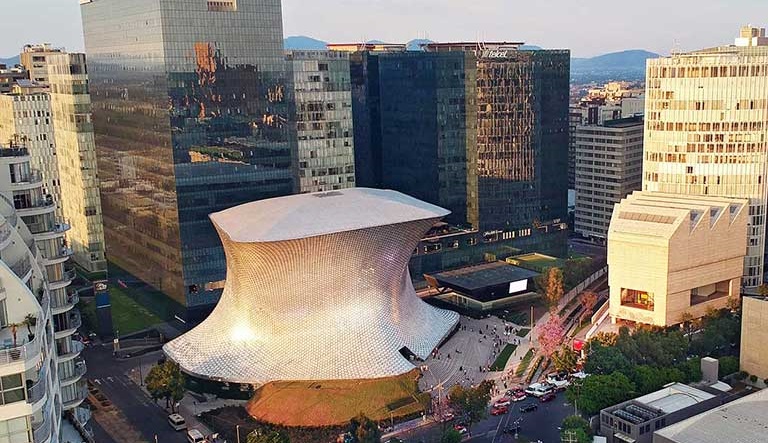

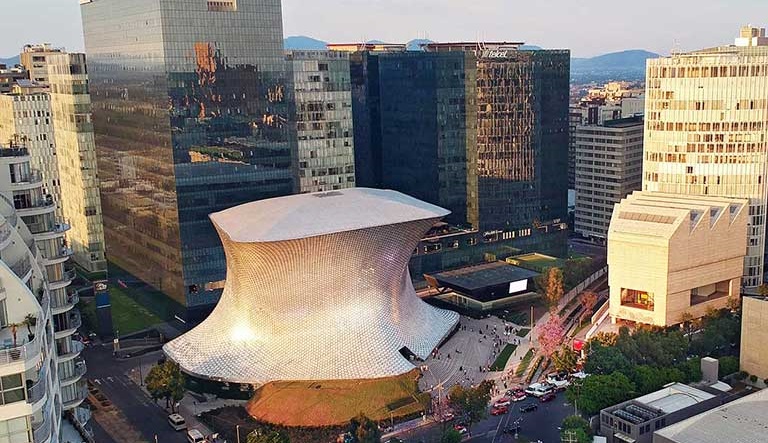

The International Bar Association, International Fiscal Association and American Bar Association, hosted the U.S. and Latin America Tax Practice Trends conference, which focused on practical tax practice trends for multinational corporations and their international advisors, as well as on providing insight into how government tax officials may view the international tax landscape in light of important developments that impact corporate taxpayers.

Our partner Juan José Paullada participated as speaker in the panel: "Moving Out: Entity Migration – Where, When and Why?", where he engaged in a discussion with other renowned experts, about the reasons why Multinationals consider migrating and the most common recipient jurisdictions. The panel also navigated the country specific tax and non-tax reasons considered by decisionmakers when facing these migrations.